How Much Does It Cost To Register A Business Name In Michigan

Here are the bones steps yous'll demand to accept to start a limited liability company (LLC) in Michigan.

A limited liability visitor (LLC for short) is a way to legally construction a business. It combines the limited liability of a corporation with the flexibility and lack of formalities provided by a partnership or sole proprietorship. Any business possessor who seeks to limit his or her personal liability for business organisation debts and lawsuits should consider forming an LLC.

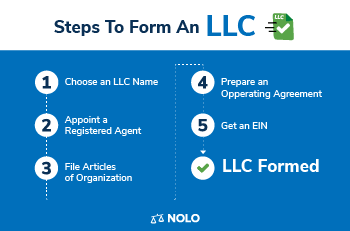

Hither are the steps to first an LLC in Michigan:

Hither are the steps to first an LLC in Michigan:

- Choose a proper noun for your Michigan LLC

- Appoint a registered agent

- File Articles of Organization

- Prepare an Operating Agreement

- Get an EIN & comply with other revenue enhancement & regulatory requirements

- File almanac statements

ane. Choose a Name for Your Michigan LLC

Your LLC's proper name must be distinguishable from the names of other business entities already on file with the Michigan Section of Licensing and Regulatory Affairs. You can bank check names for availability past searching the Michigan business database. Yous tin reserve a name for half dozen months by filing an Application for Reservation of Name with the Michigan Department of Licensing and Regulatory Affairs. You tin can mail the application or file online. The filing fee is $25.

Nether Michigan law, an LLC proper name must contain the words:

- Limited Liability Company

- Fifty.L.C., or

- LLC.

Using an Assumed Name

You don't take to utilize your LLC'south official legal name registered in your Manufactures of Organization when you do business out in the real world. Instead, yous can utilize an assumed name, also called a fictitious business name, "DBA" (short for doing business as), or trade name. To practice so in Michigan, y'all must register your assumed name with the Michigan Department of Licensing and Regulatory Affairs. You register by mail past filing a Document of Causeless Proper name. The filing fee is $25. The registration is good for 5 years. For more than on registering business organisation names, see Nolo'due south article How to Register a Business organization Name.

ii. Appoint a Registered Agent

Every Michigan LLC must have an agent for service of process in the state. This is an individual or business organisation entity that agrees to take legal papers on the LLC's behalf someone sues the visitor. A registered amanuensis may be a Michigan resident, a Michigan corporation, a foreign corporation with a certificate of authority to transact business in Michigan, a Michigan LLC, or a strange LLC authorized to transact business in Michigan. The registered agent must have a physical street address in Michigan.

3. File Manufactures of Organization

You can create a Michigan LLC past filing Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs. The articles must include:

- the LLC's proper noun

- the LLC's purpose

- whether the LLC'south duration will be perpetual or for a specified period

- the name and address of the LLC'south registered agent

- the effective date of filing the Manufactures if afterward than the date of filing, and

- signature and phone number of the LLC'south organizer.

The articles may be filed by mail or online. The filing fee is $50.

iv. Prepare an Operating Agreement

An LLC operating agreement is not required past the state of Michigan, only it is highly recommended. The agreement is an internal certificate that establishes how you will run your LLC. It sets out the rights and responsibilities of the members and managers, including how y'all will manage the LLC. It can also help preserve your limited liability by showing that your LLC is truly a separate concern entity. In the absence of an operating agreement, land LLC constabulary volition govern how your LLC operates.

v. Get an EIN & Comply With Other Tax & Regulatory Requirements

Additional tax and regulatory requirements may utilize to your LLC. These may include the following:

EIN: If your LLC has more than 1 member, it must take an IRS Employer Identification Number (EIN), fifty-fifty if information technology has no employees. If you lot grade a one-fellow member LLC, you need an EIN only if your company volition have employees or you elect to have it taxed equally a corporation instead of a sole proprietorship (disregarded entity). Yous may obtain an EIN by completing an online awarding on the IRS website. In that location is no filing fee.

Business Licenses: Depending on its type of business concern and where it is located, your LLC may need other local and state business licenses. For local licenses, check with the clerk for the metropolis or town where the LLC's principal place of business is located (or canton if information technology is in an unincorporated area). For state license data, check State License Search at the State of Michigan website. For more information, see How to Get a Minor Business concern License In Michigan.

Department of Treasury: If y'all have employees or will be selling goods and collecting sales tax, you'll need to register with the Michigan Section of Treasury (DOT). Y'all can register online using the DOT's due east-Registration application or by mail. For more information on land LLC revenue enhancement registration, check out Michigan LLC Almanac Filing Requirements.

6. File Annual Statements

All LLCs doing business in Michigan must file an almanac statement with the Section of Licensing and Regulatory Diplomacy. The report must exist filed by February xv after the year of formation or qualification. All the same, if you form your LLC after September 30, you practice not need to file a statement the following Feb. For example, if you course your business on November 1, 2020, your commencement almanac statement volition be due by February fifteen, 2022.

The country mails a pre-printed annual statement, BCS/CD-2700, to the LLC's resident agent at the registered office approximately iii months prior to the due date. You lot can file the report online or past mail service. The filing fee is $25.

The Pros and Cons of Forming an LLC

While LLCs are a pop pick for new and pocket-size businesses, the entity is not the best option for every enterprise. Before you form your LLC, consider the benefits and drawbacks of the entity.

One advantage of LLCs is that they are relatively unproblematic to course and maintain. The entity provides the owners with express liability protection, pass-through tax, and flexibility in terms of management and profit-sharing. For more information, see Advantages of an LLC.

The downsides are that, compared to a sole proprietorship, you will face more paperwork and fees to kickoff and manage an LLC. In addition, corporations are typically a better fit for businesses that want to attract investors and pursue tax deductions for employee benefits. To learn more, see Corporations and S Corporations vs. LLCs.

Source: https://www.nolo.com/legal-encyclopedia/michigan-form-llc-31760.html

Posted by: fontanaalmyconver.blogspot.com

0 Response to "How Much Does It Cost To Register A Business Name In Michigan"

Post a Comment